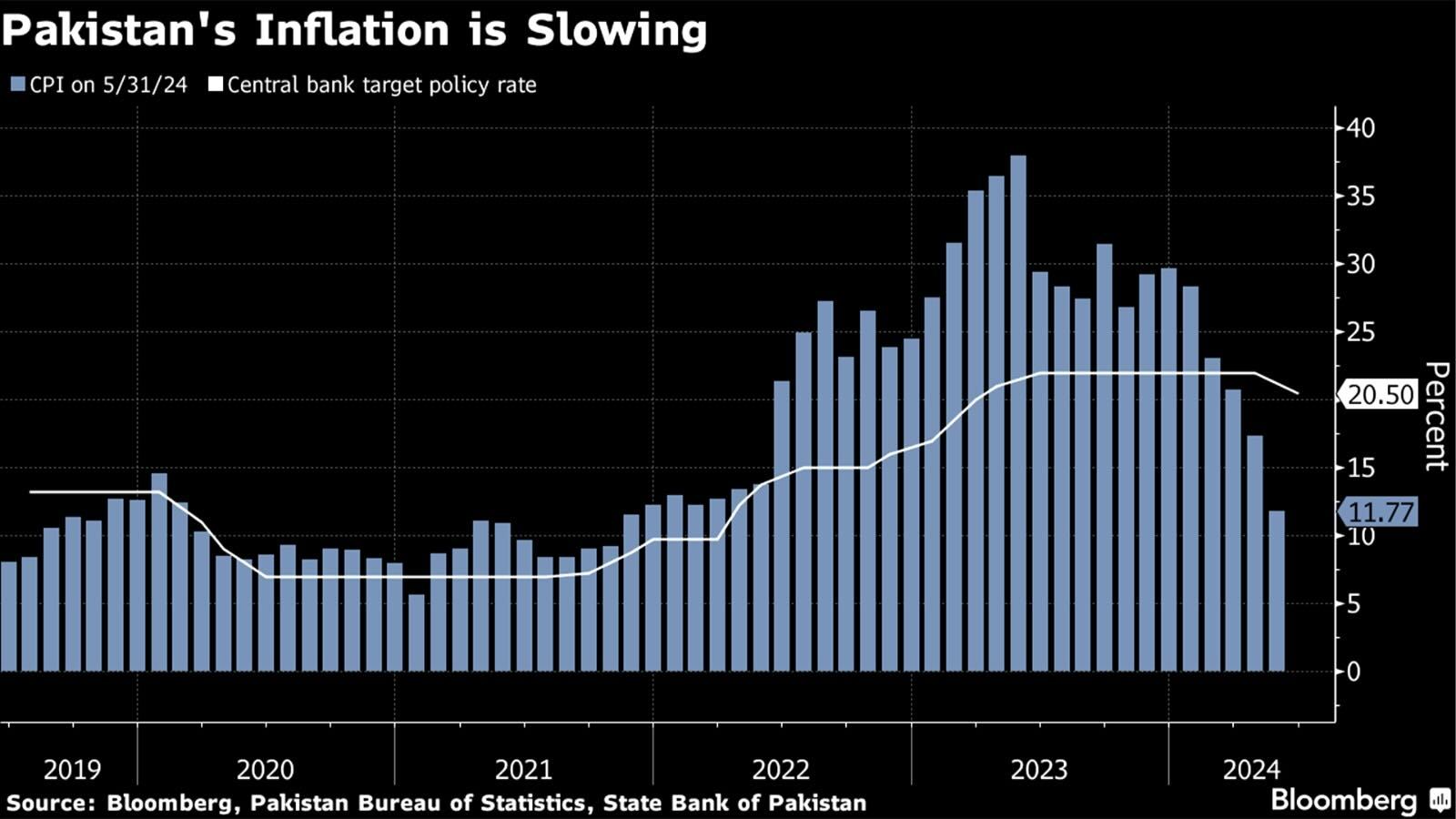

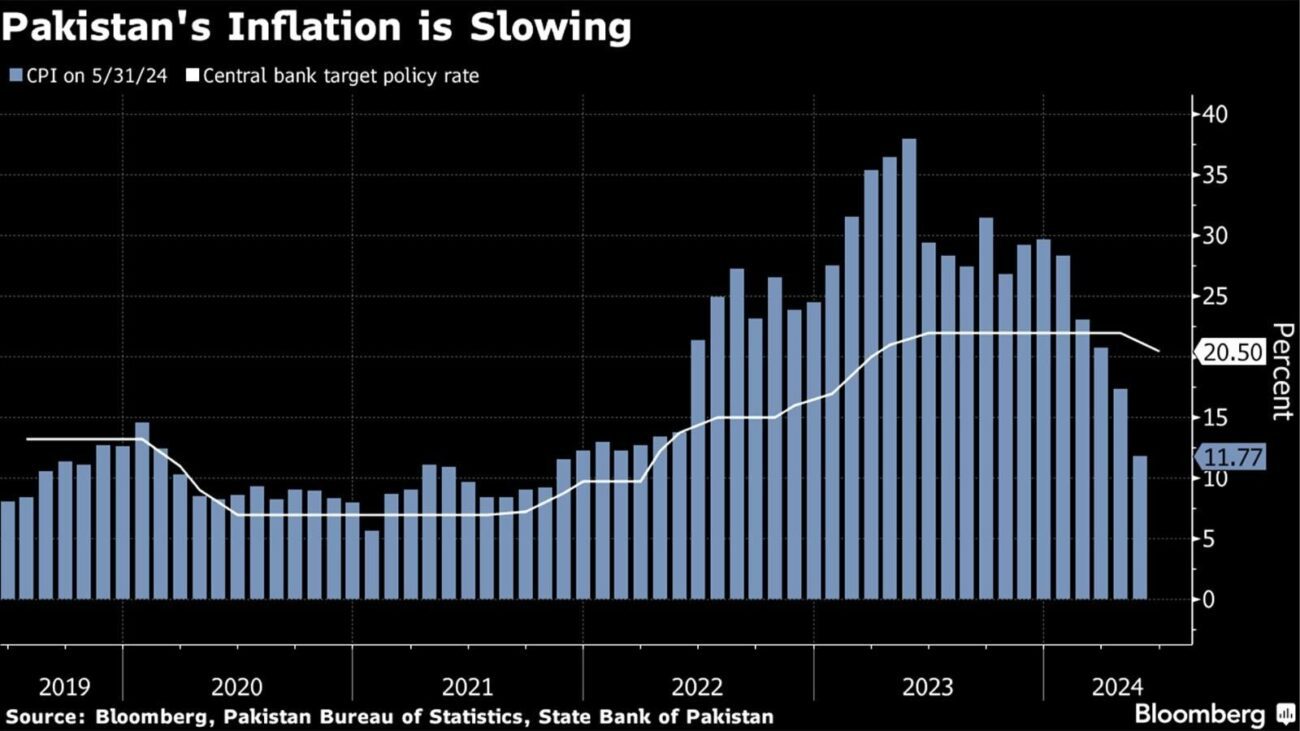

State Bank of Pakistan Reduces Interest Rates After Four Years: A Major Shift in Monetary Policy

Pulling a policy U-turn, the State Bank of Pakistan (SBP) has reduced the interest rate by 1.5 percentage points, the first cut in four years. It’s an appropriate decision now that fiscal and monetary policies are shifting gears. Financial and economic circumstances have changed.

Backdrop: A Long Period of High Interest Rates:

For the past four years, to fight inflation, steady the currency, and correct other debilitating economic imbalances, the SBP maintained remarkably high interest rates. While these steps shored up inflation and helped to keep the exchange rate in check, they also raised the cost of borrowing. For businesses and consumers alike, financing a project, home, or car became more costly. In turn, this discouraged investment and spending.

High interest rates are designed to reduce demand and cool the economy – or are deployed when inflation rises – but can also stunt growth by making money more expensive to borrow. The long period of high rates reflected the SBP’s unwillingness to dilute financial stability considerations in the pursuit of growth, especially in the face of foreign pressure and volatile shifts in the global economy.

The Decision: Cutting the Interest Rate:

This reduction was achieved by the SBP’s Monetary Policy Committee (MPC), which considers a variety of economic measures such as inflation, the growth of GDP and external economic pressures, before deciding on the stance of monetary policy.

Key factors influencing the decision include:

- Moderating Inflation: Even the latest data indicates that prices are moderating a bit so that the SBP can afford to relax monetary policy without right away risking higher prices. 2.Economic Growth: Growing concerns about slowing economic growth are the second reason why bank officials worry more about real growth rates than inflation. This ‘accommodative monetary policy’ means that interest rates have been cut to encourage economic activity by making borrowing cheaper for private businesses and consumers.

- Global Economic Environment:The SBP’s decision has been influenced by changes in the global economic environment such as shifts in interest rates by major central banks and fluctuating commodity prices. 4.Domestic Financial Conditions: Improved fiscal discipline and reforms to address structural flaws in the economy create the right conditions to lower interest rates.

Impact on the Economy

The cut in interest rates is anticipated to have various effects on Pakistan’s economy:

Lower Borrowing Costs: A lower interest rate will lead to lower borrowing costs for businesses and consumers. The prospects of a short-term boost to growth appear enhanced, with investment and spending likely to be higher as a result.

Stimulation to Growth: Low interest rates are a stimulation to growth as they make credit cheaper, resulting in more investment in infrastructure, businesses and consumer goods and so economic expansion.

Exchange Rate Dynamics: Overall, lower interest rates could trigger a depreciation of the local currency, but in view of this risk, we expect the SBP to prevent any fall in the exchange rate with other measures.

Inflation Consideration: Fear of an increase in inflation notwithstanding, the SBP’s decision reflects a balance between a higher growth and the stability of prices.

Market Reactions and Future Outlook

To be fair, the markets react positively, with many other stakeholders reading the gesture by the Fed as a sign that they are opening the floodgates in hopes of kickstarting the economy. More cautious or fearful voices warn that the slipping dollar is a harbinger of inflation in what is still a fragile economy, and sound a warning that this is the time for greater vigilance.

Going forward, the SBP is likely to take a proactive stance and fine-tune its policies based on macroeconomic indicators, so as to strike a balance between inflation targets and growth acceleration. The cut in interest rates, while significant and positive, is part of an overall framework to revive the economy and strengthen financial stability.

Conclusion:

The 1.5 percentage points cut in interest rates taken by the SBP on 26 January 2016 signals a major shift in the country’s monetary policy. Four years of high rates have come to an end, replaced by a new set of circumstances and an approach to achieving balance between growth and stability. The SBP’s stewardship of the market and economy going forward will be important as the Pakistani experiment unfolds.

On balance, the rate cut for the businesses has been commended by the local banks as favorable for both the business and the consumers, thus encouraging the SBP to adopt a more accommodative monetary policy stance towards supporting revival and strengthening of the country’s economic growth fundamentals.

Read more News from here about Government: