Trading Analysis and Famous Combinations

Trading analysis and famous combinations are indicators or prompts that help traders make decisions. Where you are going to buy or sell assets in the financial markets. Like stocks, currencies, or commodities. Various methods can be use like technical analysis, fundamental analysis, or a combination of both.

Here’s a breakdown of trading signals:

- Types of Trading Signals:

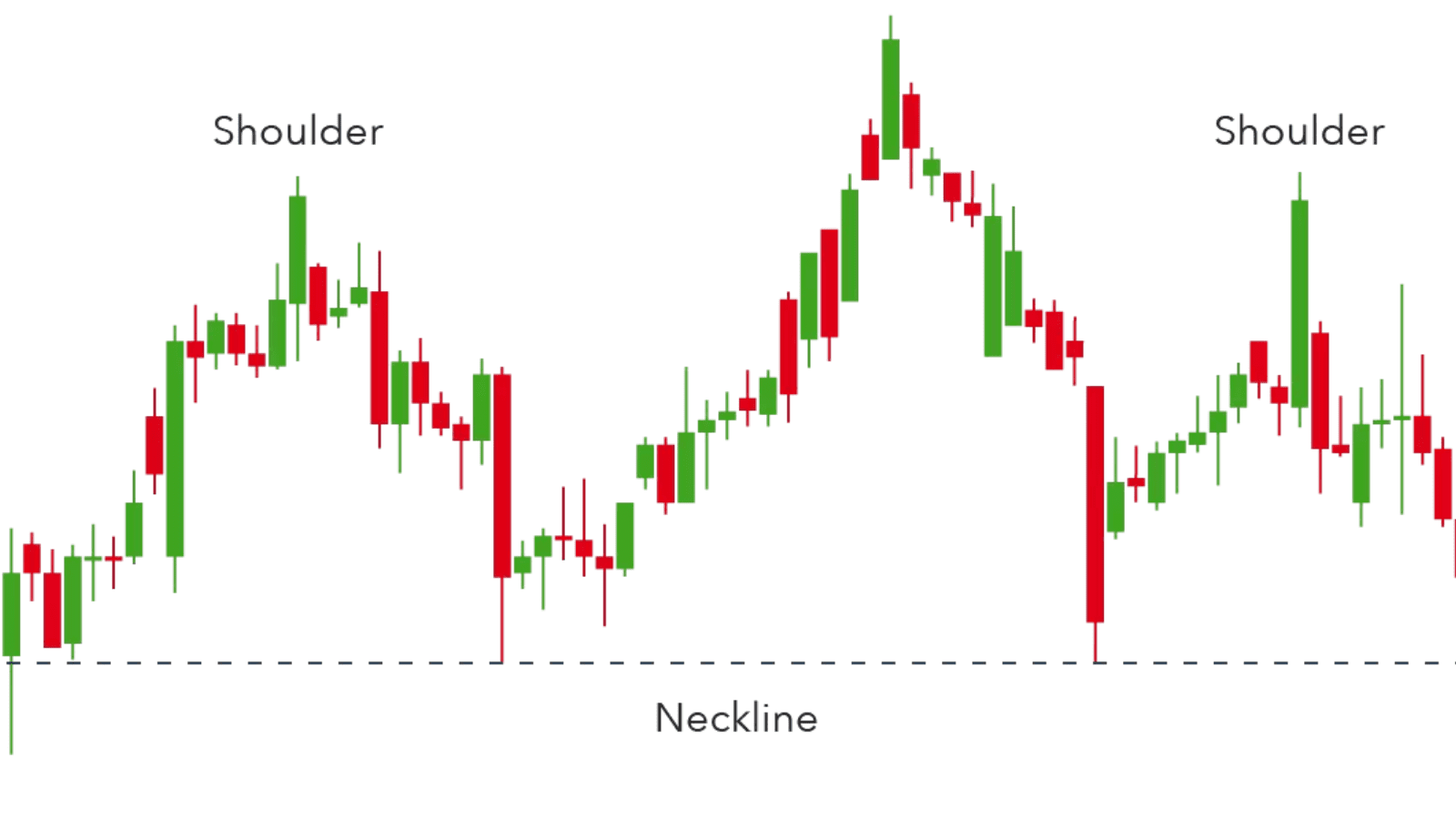

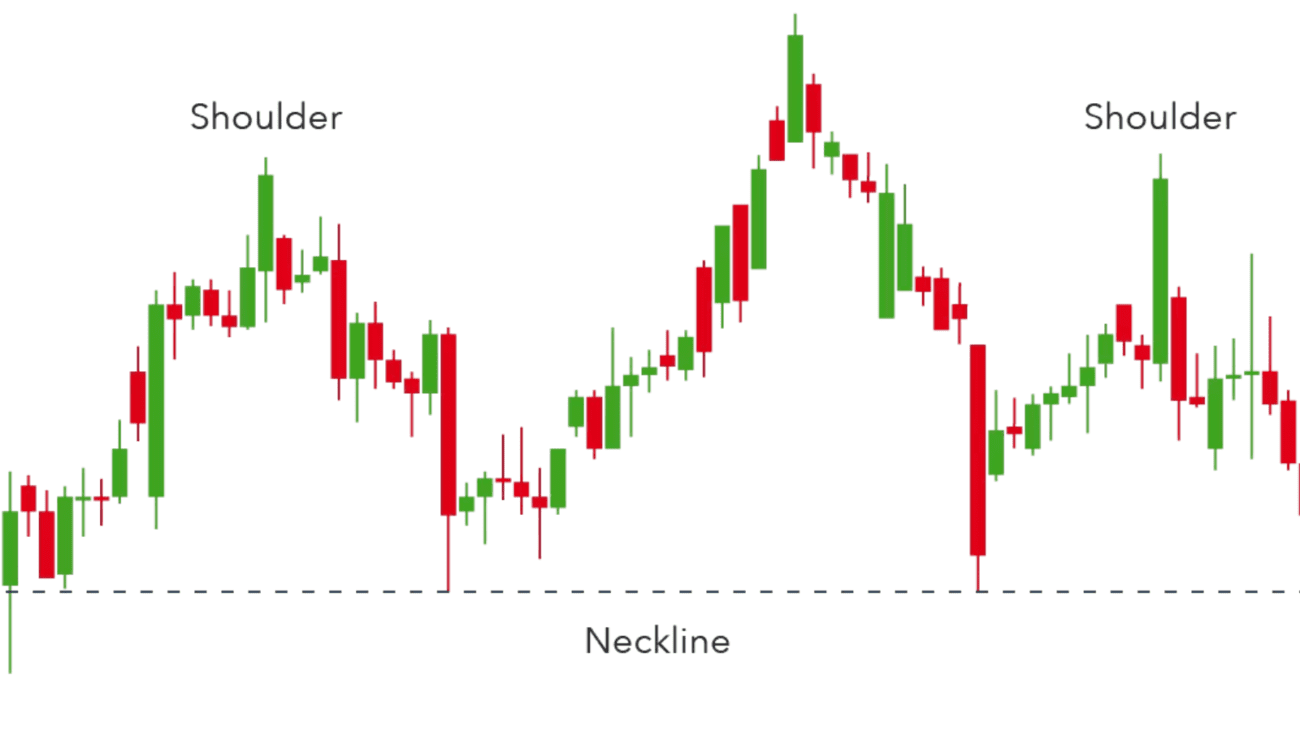

Technical Signals: These are based on historical price movements and patterns in charts.

Common tools used for technical signals include:

Moving Averages are of two types of Simple Moving Average (SMA), Exponential Moving Average (EMA))

Support and Resistance Levels, Candlestick Patterns.

Indicators and Oscillators. Fundamental Signals: These are based on the analysis of a company’s financial health, industry conditions, economic reports, etc. Key fundamentals include:

Earnings Reports, Economic Indicators, Interest Rate Changes, News Events.

https://whatshappening.pk/vpn-is-not-blocked-in-pakistan-pta-chairman/

Market Sentiment Analysis: Analyzing news, social media chatter, and investor sentiment to predict market trends.

Volume Analysis: Watching volume surges or dips to identify bullish or bearish trends.

- Sources of Trading Signals:

Automated Systems: Many traders use algorithmic trading systems or trading bots, which can scan the markets continuously and generate signals based on pre-set criteria.

Manual Signals: These signals are often provided by experienced traders, analysts, or through subscription services. They can distribute through platforms like Telegram, email, or trading apps.

Custom Indicators: Traders develop their own strategies or algorithms based on technical or fundamental indicators.

- How Trading Signals Work:

Buy Signals: These indicate a potential opportunity to enter a trade to profit from price appreciation. Common buy signals include a bullish crossover of moving averages, a breakout above a resistance level, or positive news about a company.

Sell Signals: These indicate the potential to exit a trade or short an asset to profit from price depreciation. Examples include a bearish crossover, falling below a support level, or weak earnings reports.

SL/TP Signals:

Normally traders set stop loss and take profit indicators to end their trade to avoid loss.

- Signal Reliability:

- Accuracy:

- Not all signals are guaranteed to be accurate. A trading signal can be based on an indicator that worked in the past. Sometimes signals may not work under different market conditions. Some works better in ranging markets.

Risk Management: Successful traders do not solely rely on signals for decision-making. They combine different signals with risk management techniques. - Pros and Cons of Trading Signals:

Pros:

Timesaving: Signals can help traders by providing specific entry/exit points, making the process of trading more efficient.

Objective: Signals can help remove emotional decision-making from trading, ensuring that trades are based on data-driven analysis.

Learning Opportunity: Beginners can use signals to learn how experienced traders analyze markets.

Cons:

Over-reliance: Relying solely on signals without fully understanding the market can be risky.

Risk of False Signals: No signal is 100% accurate, and traders must be aware of potential risks.

Cost: High-quality signal services often come with subscription fees.

- Popular Trading Signal Tools and Platforms:

Meta Trader (MT4/MT5): Offers a wide range of indicators and expert advisors (EAs) that provide automatic signals.

Trading View: Known for its powerful charting tools and community-driven ideas, which can act as signals.

For More Latest News regarding trading analysis and famous combinations Visit: What’s Happening in World | What’s Happening.pk

UAE as Neutral Venue for Champion Trophy 2025 | What's Happening.pk

23rd Dec 2024[…] Trading Analysis and Famous Crypto Combinations | What’s Happening.pk […]

droversointeru

31st Mar 2025I like what you guys are up too. Such clever work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my site :).