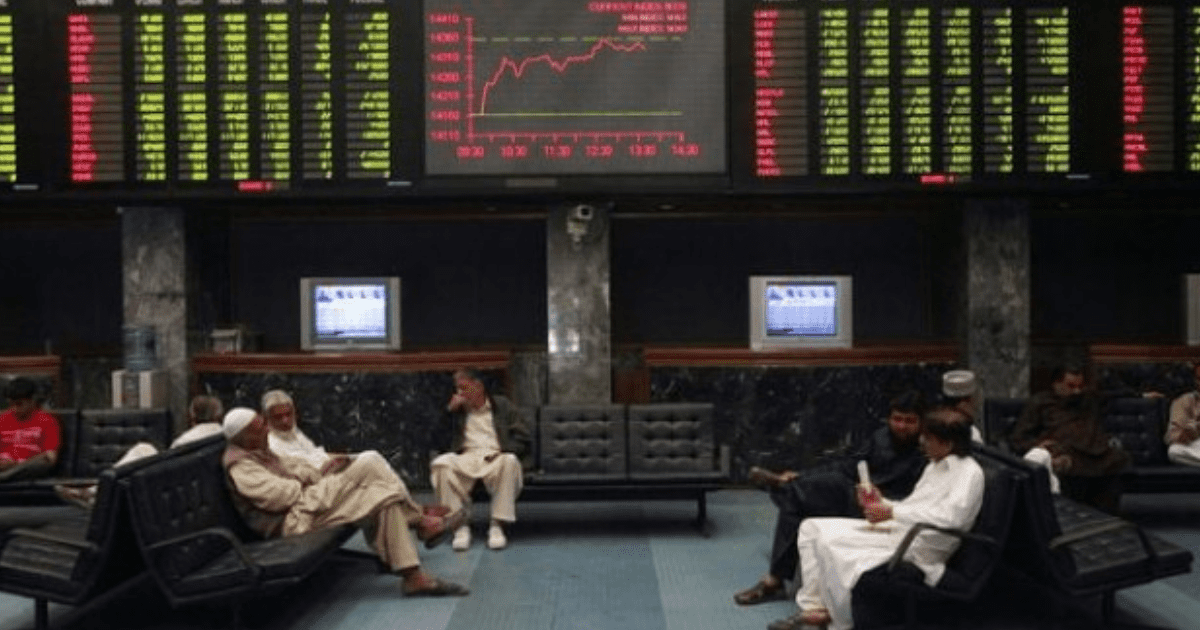

PSX Rises Modestly Amid Delay in Budget

PSX rises modestly amid delay in budget as cautious investors navigated a week of mixed sentiment, IMF negotiations, and key economic developments. The Pakistan Stock Exchange (PSX) saw the benchmark KSE-100 index edge up by 0.49% week-on-week (WoW), closing at 119,691 points.

The upward move came despite early losses, triggered by the government’s announcement that the FY26 budget would now be presented on June 10, 2025, amid ongoing talks with the International Monetary Fund (IMF). As the PSX rises modestly amid delay in budget, foreign investors remained risk-averse, pulling out $5.65 million during the week. However, local investors stepped in to counterbalance the selling.

Market Trends and Key Triggers

The PSX rises modestly amid delay in budget following initial declines early in the week. On Monday, investor concerns over the delay in the IMF’s approval of the circular debt plan led to a 0.74% drop (882 points). On Tuesday, the index added a modest 112 points, with cement stocks performing well amid speculation of a real estate package.

After a break on Wednesday due to Youm-e-Takbeer, Thursday saw a robust 638-point rally. The momentum continued on Friday, with a 720-point surge driven by optimism about pro-growth budget measures.

According to Arif Habib Limited, the KSE-100 index experienced a mixed trajectory but PSX rises modestly amid delay in budget, ending on a strong note due to positive macroeconomic signals.

Economic Highlights That Drove Momentum

- China pledged to refinance $3.7 billion in commercial loans before June’s end, providing much-needed support to Pakistan’s reserves.

- The government raised Rs772 billion through a successful T-bill auction, exceeding the Rs650 billion target.

- Cut-off yields on treasury bills declined by 9 to 15 basis points.

- State Bank of Pakistan’s reserves increased by $70 million, reaching $11.5 billion.

- Nepra approved a multi-year tariff for K-Electric at Rs39.9/unit and a 14% USD-based return on equity.

All these factors contributed to why PSX rises modestly amid delay in budget, despite lingering uncertainties.

https://whatshappening.pk/local-hero-netflix-star-humayun-saeed-talks-global-pressure/

Sector & Stock Performance

As PSX rises modestly amid delay in budget, key sectors posted notable gains:

Top contributing sectors:

- Cement (+317 points)

- Fertiliser (+249 points)

- Power generation & distribution (+148 points)

- Commercial banks (+84 points)

- Refinery (+80 points)

Negative contributors included:

- Automobile assemblers (-105 points)

- Oil & gas exploration (-97 points)

- Technology & communication (-53 points)

- Food & personal care (-46 points)

- Oil marketing companies (-43 points)

Scrip-wise positive movers were:

- Meezan Bank (+230 points)

- Fauji Fertiliser (+210 points)

- Lucky Cement (+159 points)

- Pakgen Power (+80 points)

- DG Khan Cement (+70 points)

PSX rises modestly, Outlook & Final Thoughts

PSX rises modestly amid delay in budget, despite pressure from foreign outflows and IMF-related uncertainty. JS Research’s Syed Danyal Hussain noted that while the IMF team left without finalizing terms, virtual talks continue, focusing on tax reforms and expense reduction.

Meanwhile, foreign exchange reserves got a boost from the State Bank’s net buying, which reached $223 million in February, with cumulative purchases hitting $5.9 billion in the first eight months of FY25.

With the budget now set for June 10 and support from allies like China, the PSX rises modestly amid delay in budget, indicating cautious optimism among investors.

STAY UPDATED WITH THE LATEST NEWS. FOLLOW US ON OUR SOCIAL MEDIA CHANNELS:

INSTAGRAM: https://www.instagram.com/whatshappening.pk