Repatriation April 2025 rises 115% YoY

Repatriation April 2025 marked a major turnaround in Pakistan’s foreign investment trends. According to the State Bank of Pakistan (SBP), profit and dividend outflows jumped by 115% year-on-year (YoY) in April 2025, reaching $121.5 million. This rise indicates growing investor confidence and better access to foreign exchange reserves.

Repatriation April 2025 sees sector-specific shifts

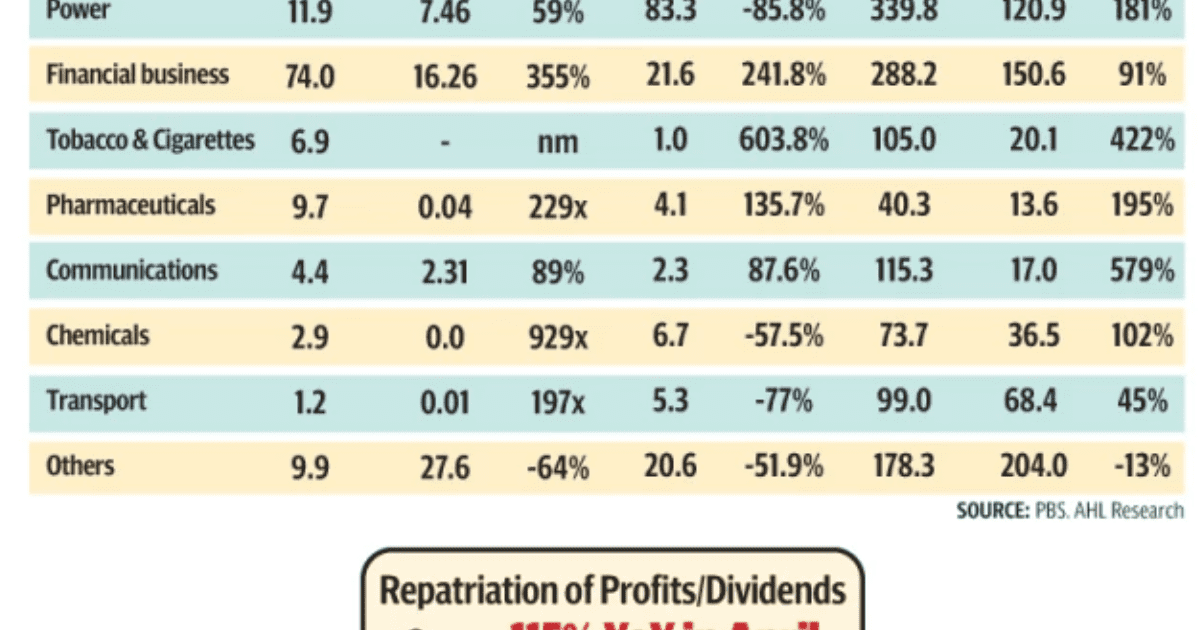

Despite the annual surge, April’s figure was 23.1% lower than March 2025, when repatriation hit $157.9 million, noted Arif Habib Limited (AHL). Insight Securities’ Ali Najib attributed the boost mainly to the financial business sector. Communications, food, and pharmaceuticals also showed sharp YoY increases. In contrast, repatriation from oil and gas, cement, and miscellaneous sectors declined.

https://whatshappening.pk/india-pakistan-ceasefire-claim-denied-by-india/

Najib added that repatriation patterns have shown high volatility. The trend peaked in May 2024 at $918 million, followed by moderation. The first ten months of FY25 (July to April) saw total repatriation rise to $1.83 billion. That’s a 107% YoY increase from $882.6 million in FY24.

Repatriation underlines investor sentiment

Repatriation April 2025 highlights how a stable currency and fewer foreign exchange restrictions can improve investor trust. For instance, repatriation from the oil and gas sector plunged 92% YoY to $0.1 million. Cement saw zero outflows, down from $1 million last April. The “others” category shrank by 64% to $9.9 million.

In 10MFY25, the financial sector led with $288.2 million repatriated. The power sector followed with $339.8 million—a massive 1816% increase. The food industry repatriated $291.1 million, up by 1671%. Communications reached $94.6 million, oil and gas exploration $109.3 million, and tobacco $105 million.

This monthly pattern confirms that repatriation peaked in May 2024 due to macroeconomic improvements and delayed remittances. April 2025’s $121.5 million signals a moderate recovery after a slower start to the year.

Analysts link the rise to the ongoing IMF program and improved reserves. Easing restrictions on dollar outflows also helped. Future trends will depend on global interest rates, local economic health, and investor confidence.

Repatriation April 2025 is a strong sign of investor optimism in Pakistan’s economy. While not without challenges, the improved macroeconomic landscape and policy easing have enabled foreign firms to repatriate earnings more freely. Though some sectors lagged, overall momentum is positive. The second half of FY25 may bring even greater recovery if domestic and global conditions stay favorable. This trend not only reflects economic resilience but also builds hope for long-term growth and stability.

STAY UPDATED WITH THE LATEST NEWS. FOLLOW US ON OUR SOCIAL MEDIA CHANNELS:

INSTAGRAM: https://www.instagram.com/whatshappening.pk

Boys Season 5 finale kicks off with buzz and emotions - What's Happening.pk

20th May 2025[…] https://whatshappening.pk/repatriation-april-2025-rises-115-yoy/ […]